Arriving from the concept of e-banking and branchless banking, mobile money has proved be a viable alternative to cash. Over the years, the mobile money ecosystem has been working towards providing a range of seamless financial services that can be offered to every customer.

This system of transacting and executing payments has been able to successfully transform the financial services framework both by complementing and disrupting the traditional way of banking. Owing to its safe, easy and affordable transacting ways, mobile money is touted as a popular alternative to bank accounts and the fact that it can be used on both smartphones and basic feature phones.

The technology behind mobile money has been able to leverage the trend of mobile penetration and forming an agent infrastructure. Not only in the solutions for mass market and high-volume, low margin business, but mobile money has shaped the way for micropayments too. The e-wallet used for monitoring, collecting and distributing micropayments can now be effectively used by network providers under the mobile money ecosystem. Additionally, it has given birth to a high-volume, low margin business model for the mass markets. Its rapid adoption majorly lies in its ease of access and is only expected to grow in future.

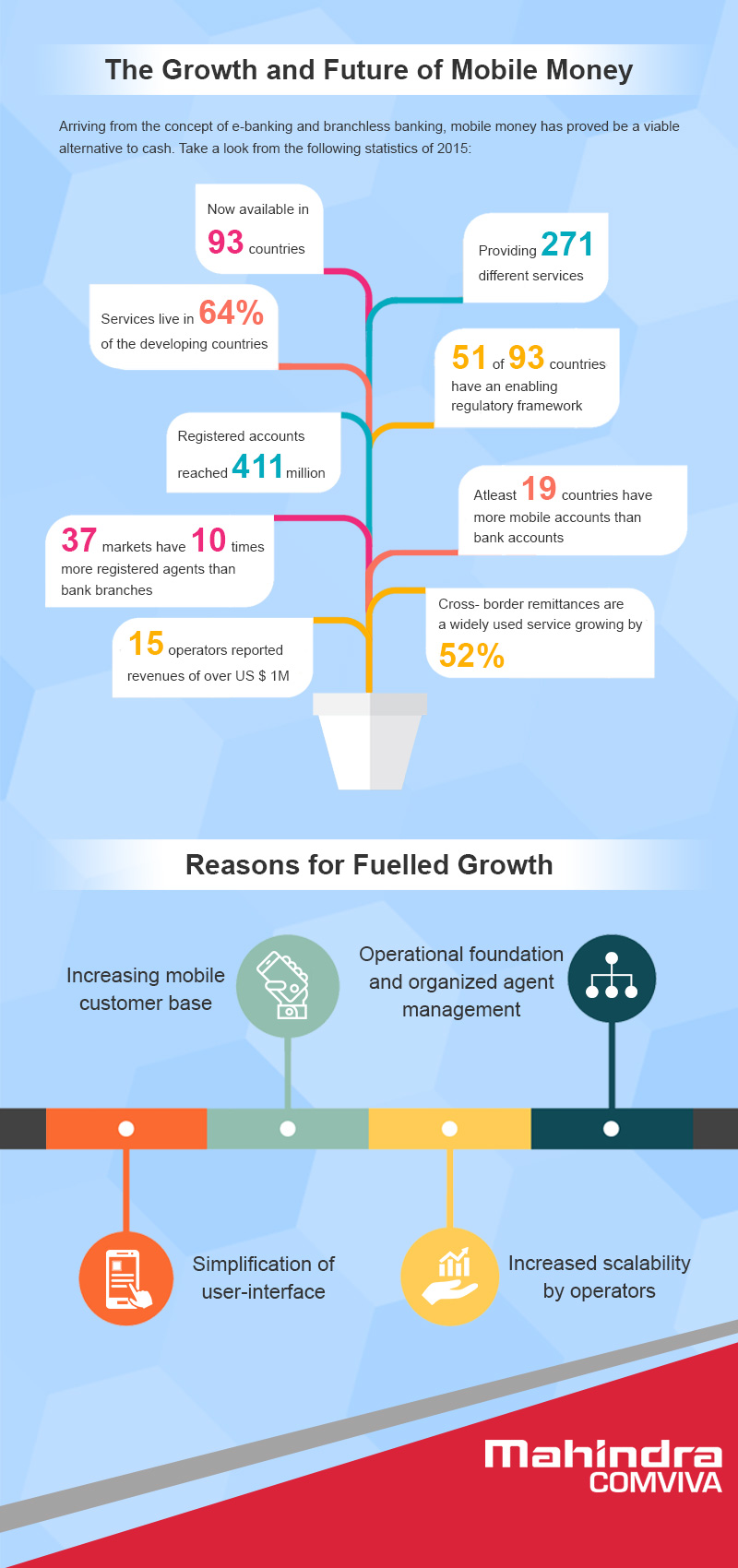

Mobile money is widely available in 93 countries providing as much as 270 services worldwide. As of June 2015, revenue generated by mobile money grew at a CAGR of 40 per cent. The providers of such services (telecom operators) are witnessing greater contribution of mobile money in the total revenue, encouraging more and more operators to provide them under their umbrella of service offerings.

Mobile Money: Fast Track Growth

The number of registered mobile money accounts touched 411 million by 2015. The number of active mobile money accounts is estimated to be 134 million and about 100 million new accounts have been added since 2014. Seeing the abundance of opportunity, the number of agents has increased touching as much as 3.2 million by December 2015. (Data source: 2015 Global Adoption Survey; GSMA State of the Industry Report-2015)

A rising trend in mobile money services is evident in developing nations with 86 out of total 135 developing countries (64%) are adopting one or more such services. The low-income economies are also not far behind in transacting via mobile money with almost 81 per cent of them using these services and remarkably their adoption rate is higher than lower-middle income economies and upper-middle income economies. Additionally, Sub- Saharan Africa and South Asia are one of the most active regions using mobile money services. (Data source: GSMA Mobile Money Deployment Tracker)

Mobile money has disrupted traditional banking and financial systems. This can be proven by the fact that by 2015, about 37 markets had ten times more registered agents of mobile money services than bank branches. It is because of the mobile money services that some of the economies in the world are able to fulfill the goal of financial inclusion. According to World Bank data on global financial inclusion, mobile money services are available in 85 per cent of countries where the number of people with a bank account is less than 20 per cent. In 2015, 51 out of 93 countries started providing mobile money enabled regulations and policy improvements to ensure a secured system and achieve financial inclusion. (Source: World Bank, Global Financial Inclusion Database-2015)

The number of transactions processed by mobile money industry was over 12 billion transactions by December 2015. The volume of transactions performed by unregistered customers via OTC was about 37 million by June 2015. Even the average value of each transaction is going up. In 2015, the average value per transaction in cash-in services was $29 and in cash-out services was $32.60. (Source: GSMA State of the Industry Report-2015; under “a month in the life of the average active customer.”)

New Mobile Money Services

In 2015, the number of mobile money services increased to 271 in 93 countries. The rapid introduction of newer mobile services increased user engagement and driving them to maintain their investment in the mobile money accounts. Out of the total number of accounts, three-fourth of customers maintained or increased their investments in the account over the previous year.(Source: GSMA State of the Industry Report-2015)

Sub-Saharan Africa accounts for the majority of live mobile money services (52 per cent). More than half of new services launched in 2015 were primarily in Latin America and the Caribbean regions. New mobile money services are expected to grow by as much as 50 per cent in Europe and Central Asia as well as in the Middle East and parts of North and West Africa. (Source: Claire Scharwatt and Chris Williamson (2015), “Mobile money crosses borders: New remittance models in West Africa”, GSMA Mobile Money for the Unbanked)

Interoperability and international remittances have become one of the fastest growing services in mobile money ecosystem. By 2015 there were 29 cross-border mobile money initiatives connecting about 19 countries. International remittances grew in volume by 52 per cent indicating how useful the mobile money has become in serving the needs of cross border trade and regional economies.(Source: United Nations, “International Migration 2013”)

Factors fuelling the growth in Mobile Money:

More regulators are recognizing the importance of creating an open and leveled playing field for mobile money services. Major factors responsible for the rapid development of the mobile money ecosystem are:

- Increasing mobile customer base: With an ever-increasing active customer base, the further development of the mobile money ecosystem was made easier than it ever was in diversifying the customer usage and service portfolio of the providers. The network providers and agents saw the bigger picture and invested in building a broader ecosystem of mobile money driving usage in new products and services making mobile money capable of impacting both commercial as well as social avenues. Providers of the mobile money services are striving to make such services more sustainable, profitable, and relevant to customers in the long term.

- Operational foundation and organized agent management: This factor became essential to grip on the trend of the widespread mobile money services and to digitize cash. Operations and seamless transactions lie at the core of this success. Agents remain the backbone of mobile money system and act as a face of mobile money to enable digitization and disbursement as compared to the lagging process of banking.

- Simplification of user-interface:A lot of re-designing is being carried out to simplify both the physical access through agent networks and technical access through the mobile interface. Which is why, the easy-to-use interface to initiate mobile money transactions became a faster driving force for the rapid adoption of mobile services globally as this factor is critical to any system. The mobile money services ensure that a minimal time is taken to process and complete the transaction.

- Increased scalability by operators:The rising number of providers and agents of mobile money services drove the rapid adoption and customer activity levels. Alongside as the mobile broadband is now fast-spreading and being made available to rural and underserved segments, the potential of such services seems incredibly scalable and for long. This is the reason why providers or operators are more than willing to invest heavily in mobile money services.

Conclusion

The evolution of the business model in mobile money is becoming increasingly critical against the broader landscape of payments and financial technology, where investments have tripled and reached more than $12 billion.

In future, transport, e-commerce and credit system will be increasingly relevant for mobile money adoption in markets where traditional financial services are more established and operators will have huge business potential to tap on, when even the population without a bank account is relying heavily on such services.